How to calculate cost of borrowing

The amount you want to borrow the cost of any fees you might have to pay the frequency of repayments for example. Heres a simplified way of looking at it.

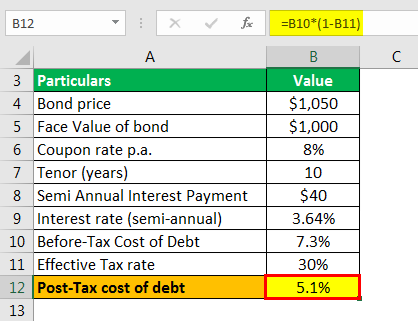

Cost Of Debt Definition Formula Calculate Cost Of Debt For Wacc

Ad Our Resources Can Help You Decide Between Taxable Vs.

. This isnt an exact calculation because the amount of debt you carry over the course of. Step 1 Format your spreadsheet. If I had a short position of 50000 in XYZ my.

Eligible Borrowing Cost Actual Borrowing Cost Income from temporary investment of funds. Step 1 Column A Identify all of the sources of money. Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income.

Skip the Bank Save. Calculating the incremental borrowing cost allows you to weigh your financing options more clearly. Pre-Tax Cost of Debt 28 x 2.

0005 6 annual rateexpressed as. Click Now Apply Online. How APR the cost of borrowing is calculated.

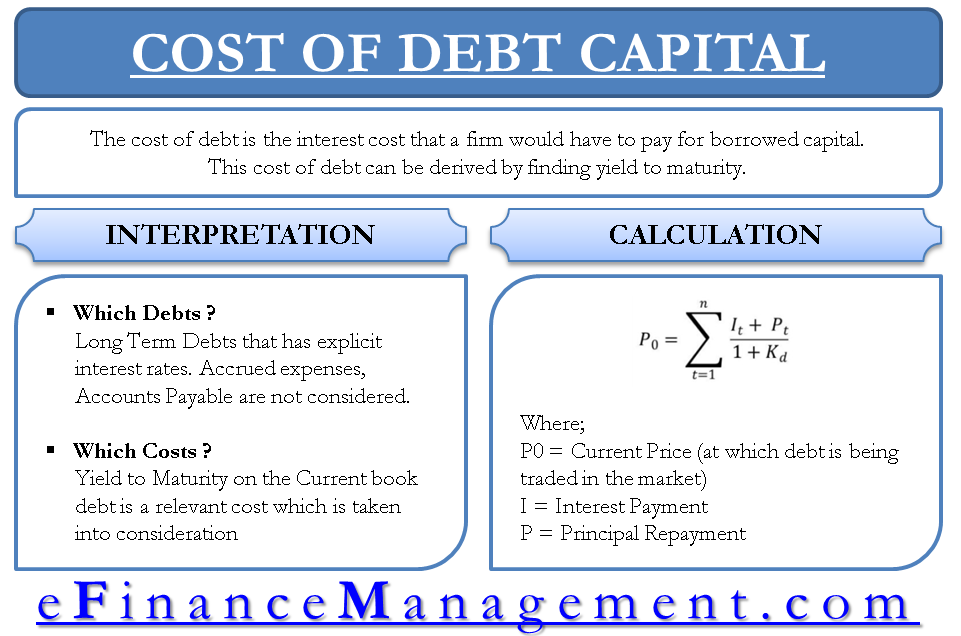

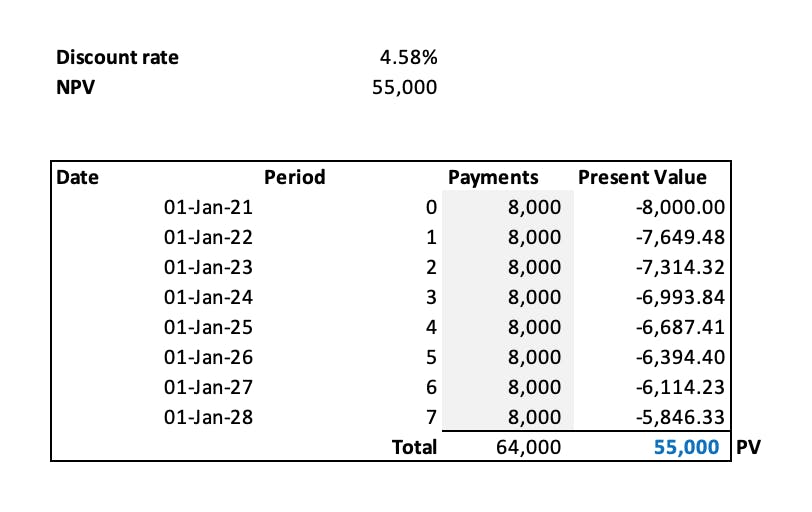

The first approach is to look at the current yield to maturity or YTM of a. 4 Simple Steps to Calculate the Cost of Money for Your Small Business. Borrowing and savings calculator Use our interest rate calculator to see how interest rates affect borrowing and saving.

Divide the first figure total interest by the second total debt to get your cost of debt. A mathematical technique is to calculate what interest rate. What this means is that you will get charged 20 interest on your short position annually for being able to borrow the shares.

Ad Rich options pricing data and analytics for institutional use. Analytic and Tick Data. In cell A1 write Amount Borrowed In cell A2 write Interest Rate In cell A3 write Term Years In cell A4 write Monthly Payment In cell A5 write Total.

There are two common ways of estimating the cost of debt. Estimating the Cost of Debt. The interest cost over 25 years in 50053.

Deep Historical Options Data with complete OPRA Coverage. 100000 the amount of the loan. How to use our calculator Choose how much you want to save or.

To calculate the monthly payment convert percentages to decimal format then follow the formula. With mortgages and other loans lenders use the remaining balance method. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

Advertisement Step 1 Compare the payment tables for the two illustrations. You must however pay back 250000 to the lender. Let us create a spreadsheet with 4 columns.

Principal Total Amount Borrowed Interest Fees APR Total Cost of Borrowing What this shows is theres more to loans than just interest rates. How to calculate loan payments and costs 7 min read. Get Instantly Matched with the Best Personal Loan Option for You.

Service website has a mortgage calculator and mortgage affordability. They multiply the interest rate by the. In essence you are making monthly payments of 8885 based upon borrowing 1000 at 12 but now youre only getting 990.

Ad We Picked the 10 Best Personal Loan Companies of 2022 for You. Cost of Debt Calculation Example 1 Provided with these figures we can calculate the interest expense by dividing the annual coupon rate by two to convert to a semi-annual rate and then. Working out the true cost of borrowing means taking into account.

40000 9 3125 Eligible Borrowing Cost 32875 W3. Along with the amount of your loan your interest rate is extremely important when it comes to figuring out the total cost. Even if the difference in interest rate is only half a percentage point the.

They multiply the interest rate by the. The method that is used can change the cost of borrowing.

Cost Of Debt Kd Formula And Calculator Excel Template

Interest Rate Vs Annual Percentage Rate Top 5 Differences Interest Rates Percentage Rate

How Can I Calculate Compounding Interest On A Loan In Excel

How To Calculate Free Cash Flow To Equity 11 Steps

Excel Formula Calculate Payment For A Loan Exceljet

Cost Of Debt Kd Formula And Calculator Excel Template

Excel Formula Calculate Interest Rate For Loan Exceljet

Efinancemanagement Financial Life Hacks Finance Accounting And Finance

Excel Formula Calculate Loan Interest In Given Year Exceljet

Cost Of Debt Kd Formula And Calculator Excel Template

Understand The Total Cost Of Borrowing Wells Fargo

Borrowing Base What It Is How To Calculate It

Difference Between Lease And Finance Economics Lessons Accounting And Finance Finance

Cost Of Debt Should Be Interest Cost On Capital Yield To Maturity Efm

Types Of Financial Statements Bookkeeping Business Learn Accounting Financial Statement

Degree Of Total Leverage Meaning Calculation Importance And More Financial Ratio Learn Accounting Financial Management

How To Calculate The Discount Rate Implicit In The Lease