42+ what percent of gross income for mortgage

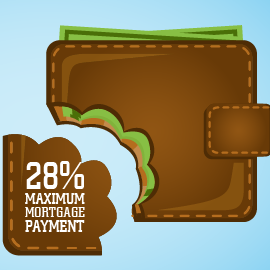

Keep your mortgage payment at 28 of your gross monthly income or lower. With a Low Down Payment Option You Could Buy Your Own Home.

42 Sample Budget Checklists In Pdf Ms Word

Ad Tired of Renting.

. Learn About Our Loan Options Including Conventional FHA VA And Other Mortgages. Web The Bottom Line. Ad Learn More About Mortgage Preapproval.

To get the back-end ratio add up your other debts along with your housing expenses. Scroll down the page for more. With a Low Down Payment Option You Could Buy Your Own Home.

When determining what percentage of. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment. In that case NerdWallet recommends an annual pretax income of at least 184656.

Why Rent When You Could Own. With a Low Down Payment Option You Could Buy Your Own Home. How Much Interest Can You Save By Increasing Your Mortgage Payment.

Use NerdWallet Reviews To Research Lenders. Web This means that if you want to keep your DTI ratio at 43 you should spend no more than 18 900 of your gross income on your monthly payment. Web There are four common models prospective homebuyers use to calculate the percentage of income they should spend on a monthly mortgage payment.

Web Mortgage income requirements in 2023. Ad Learn More About Mortgage Preapproval. Web For example if you make 3500 a month your monthly mortgage should be no higher than 980 which would be 28 percent of your gross monthly income.

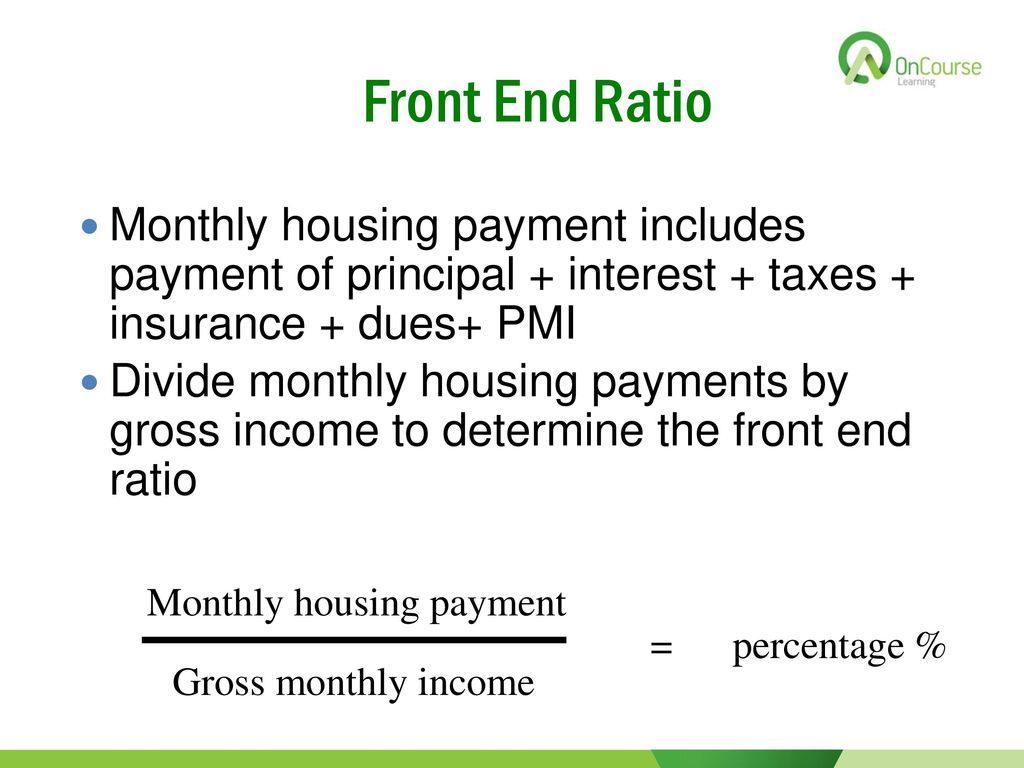

Browse Information at NerdWallet. Web Your front-end or household ratio would be 1800 7000 026 or 26. Heres how lenders typically view DTI.

Browse Information at NerdWallet. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Find A Loan Officer Near You.

Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. Take Advantage And Lock In A Great Rate. Ad Tired of Renting.

Web Non-housing expenses include debts such as car payments student loan payments alimony or child support. Web According to this rule a household should spend a maximum of 28 of its gross monthly income on total housing expenses and no more than 36 on total debt. Lenders want to make sure these expenses dont exceed 36 of your monthly.

Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. Ad See Why CMG Mortgage Is So Highly Rated By Our Customers. Keep your total monthly debts including your mortgage.

Use NerdWallet Reviews To Research Lenders. According to the FHA monthly mortgage payments. Web As a general rule of thumb your monthly housing payment should not exceed 28 percent of your income before taxes.

Why Rent When You Could Own. With a Low Down Payment Option You Could Buy Your Own Home. This is the percentage of your gross monthly income your pre-tax income before deductions that goes toward.

43 Percent of Income for Mortgage Approval. Take Advantage And Lock In A Great Rate. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

The Federal Housing Administration FHA also has limits on the percentage of income you can put toward. Web The calculator works immediately as you slide or input your gross monthly income monthly debts loan terms interest rate and down payment. Web If youd put 10 down on a 555555 home your mortgage would be about 500000.

Web The rule of thumb is that you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt load. Web Back-end DTI includes all of your debt payments in addition to the proposed mortgage payment.

Mortgage Broker Southport Labrador Ashmore Surfers Mortgage Choice

What Percentage Of Your Income Should Go Toward Your Mortgage

What Percentage Of Your Income Should Your Mortgage Be

What Percentage Of Income Should Go To A Mortgage Thrive

California Real Estate Principles 10 1 Edition Ppt Download

What Percentage Of Income Should Go To Mortgage

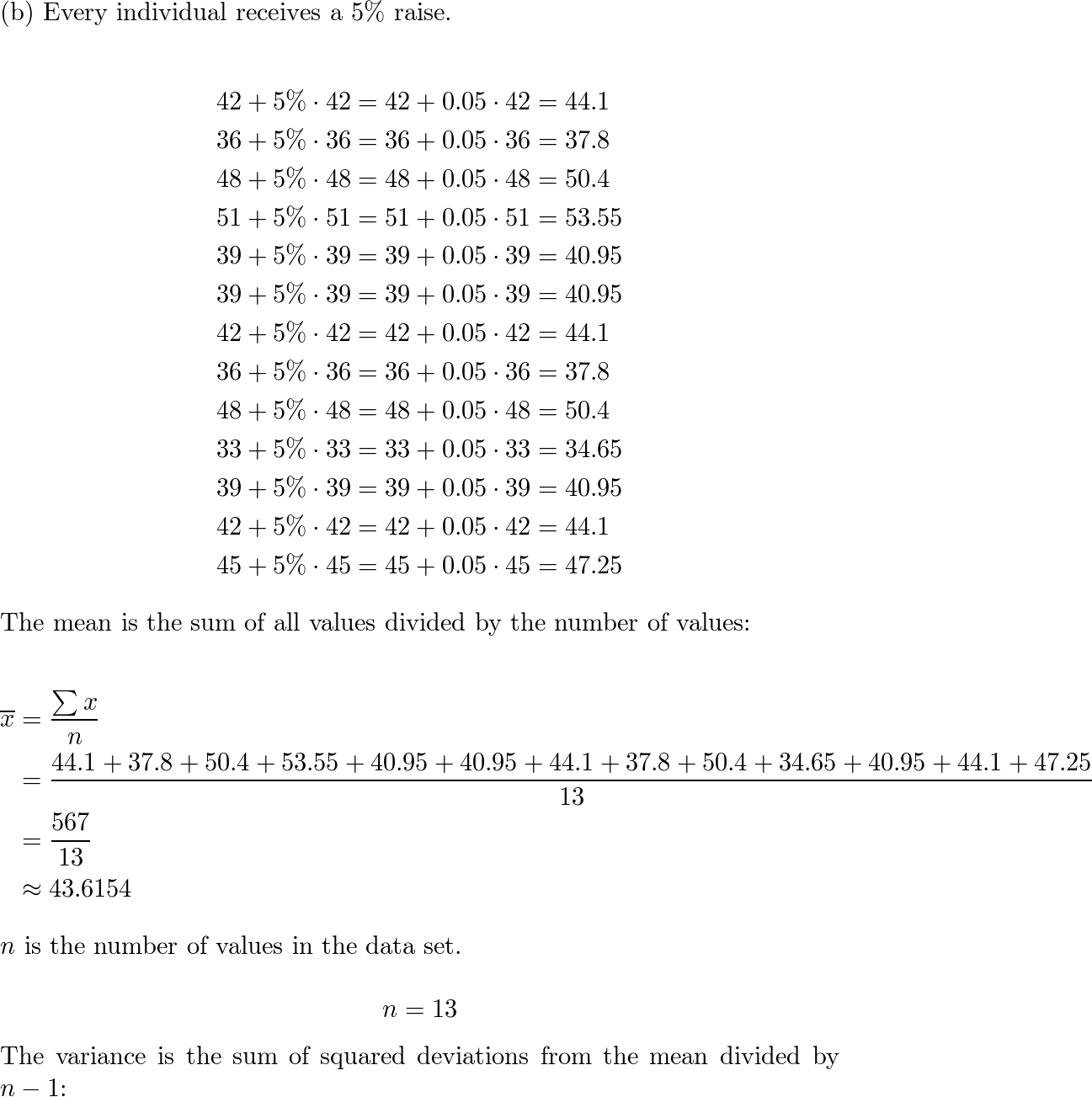

Sample Annual Salaries In Thousands Of Dollars For Employe Quizlet

What Percentage Of Your Income Should Go To Your Mortgage Hometap

How Much Of My Income Should Go Towards A Mortgage Payment

Housing Affordability Presentation

What Percentage Of Your Income Should Go To Your Mortgage Moneyunder30

What Percentage Of Income Should Go To Mortgage Morty

Test By Giladn Issuu

What Percentage Of Income Should Go To A Mortgage Bankrate

28ac Rr 3 Winfield Road Fairmont Wv 26554 Mls 10139859 Howard Hanna

Business Succession Planning And Exit Strategies For The Closely Held

What Percentage Of Your Income Should Your Mortgage Be